Return to Shareholders and Tax Payment

Bank of China makes constant effort to improve the capability of creating values for shareholders. From 2006 to 2007, the operating income increased from RMB 148,378 million to RMB 182,712 million, the after-tax profit increased from RMB 48,264 million to RMB 62,036 million, the ratio of impaired loans decreased from 4.24% to 3.17%, the return on average equity was 14%, and the return on assets (ROA) increased from 0.96% to 1.10%.

Bank of China is among the top tax payers. In 2005, it ranked the third in China's Top 100 Tax Payers and the second in China's Top 100 Corporate Income Taxpayers. It ranked the second on the list of China's Top 100 Taxpayers and was rated as a Class A tax payer in Beijing in terms of tax payment credit standing. The corporate income tax paid in 2007 was RMB 28,661 million, with 45.69% increase compared with that of 2006.

Support for Export-Oriented Economy

The export-oriented economy has long contributed high to China's economic growth. Being a main financial service provider for the export-oriented economy with its professional foreign exchange management and network advantages, Bank of China plays an important role in international settlement and trade finance by offering services such as L/C, collection, L/G, factoring and trade financing to domestic and foreign-funded enterprises engaged in "bring in" and "go out" business activities.

Bank of China took the lead in launching "online customs declaration" series services including customs guarantee, security for online duty and fee payment, put warrant letter of guarantee, forfeitings with D/A note and export credit insurance. In 2007, in collaboration with China Export & Credit Insurance Corporation, Bank of China initiated the non-recourse financing business with export credit insurance by mixing the forfeiting transaction with export credit insurance, providing a "Golden Path" for Chinese enterprises towards the international market. In 2007, Bank of China joined in the Trade Services Utilities (TSU) of the SWIFT and then developed new financing products based on credit sale settlement, making the first real "TSU" transaction in China.

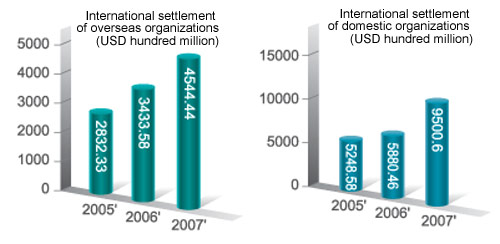

The international settlement of domestic and overseas organizations reached USD 1.4 trillion in 2007, making the bank the first commercial bank in the world with annual international settlement exceeding USD 1 trillion.

By taking advantages of its branch network at home and abroad and multiple operations of commercial banking, investment banking and insurance business and through business portfolio of global credit line, international settlement, treasury, cash management and investment banking, Bank of China provides robust support for famous domestic enterprises such as CNPC, Sinopec, China Minmetals Corporation, China Huaneng Group, COSCO, China Construction, China Communications Construction, China Mobile, Huawei and ZTE Corp, satisfying their multiple demands for overseas financing, project acquisition, fund management, financial consultation and credit service.

As the sole undertaker of the "special fund for L/G risks of overseas contracted projects" of the Ministry of Commerce, Bank of China issues tender L/G, performance L/G and advance payment L/G to qualified domestic contractors of foreign projects, which have supported over 80 large-scale contractors for their projects in more than 60 countries and regions. The support cover construction of houses, dams, power stations, oil product pipelines, roads, sanitary facilities, water supply and sanitary engineering projects, sewage disposal projects, factory reconstruction and reformation, railways and other public and civil facilities with the contract value up to USD 26.9 billion.

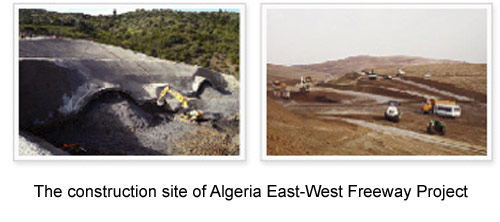

Bank of China offers credit support to Chinese enterprises for overseas construction projects. In 2006, the bank credited L/G of RMB 40.5 billion for the middle and west sections of the Algeria East-West Freeway Project to China International Trust and Investment Corporation and China Railway Construction Corp. After their joint bid winning, thus ensuring smooth construction of the project.

Diversified Corporate Financial Services

Bank of China offers diversified financial services for state-owned enterprises, private enterprises, foreign-funded companies, financial institutions and government organizations. It has established a long-term stable relationship with many big corporate customers by providing such financial services as loans, bill discounting, international settlement and financing, deposits, settlement and clearance. Its comprehensive service capability is improved through linked marketing via the syndicated loan centers in the Africa-Europe, Asia-Pacific and America regions and the diverse service platform composed by Bank of China State Trust, Bank of China Trust and Bank of China Group Insurance.

On one hand, Bank of China offers strong support to large and medium-sized projects, industrial leaders and large enterprises with strong power and technical advantages in line with the state's industrial policies in key areas by focusing on environment-friendly and energy saving enterprises; on the other hand, the bank reduces or terminates the credit for projects with high energy consumption, high pollution, low credit rating and lack of scale and technology advantages.

With the corporate online banking platform, Bank of China provides services of RMB account management, collection and payment management, centralized management of internal capital as well as collection and management of foreign exchange capital. The amount of corporate online banking exceeded RMB 27 trillion as of 2007, an increase of 154.69% over the previous year, with the service expanded to nine overseas branches.

To adapt to the changing demands of corporate customers, Bank of China promotes the research and development of the supply chain financing products with the introduction of accounts receivable based financing services, accounts receivable pledged L/C, as well as accounts receivable financing services based on export credit insurance and goods pledged financing business.

Acting as corporate financial advisor, Bank of China provides corporate customers with services of structured financing arrangement, IPO and bond issuing consultation, M&A and restructuring consultation, entrusted asset management, enterprise credit service as well as overseas business consultation.

Bank of China has participated in overseas aircraft financing projects such as French taxation financing and Japanese taxation financing many times, serving main domestic airlines as its customers and maintaining the leading position in this area at home. The bank also keeps good relationships with major domestic shipping enterprises and has participated in many large-scale ship financing projects.

It is the first to launch syndicated loan business in China, having led or participated in tens of syndicated loan projects at home and abroad. With the three overseas syndicated loan centers set up in Europe-Africa, Asia-Pacific and America regions successively as of 2007, the bank became the leader in the domestic syndicated loan market.

Professional Individual Financial Services

Taking "customer focus" as its operation principle, Bank of China takes active initiatives to improve its service capability in response to the increasing financial service demands of individual customers.

From 2005, Bank of China took active actions in outlet arrangement optimization and strove to improve customer experience by focusing on outlet transformation with outlets functional division, outlets condition improvement, adding lower counters and optimizing over-the-counter procedures. By the end of 2007, Bank of China had finished the transformation of over 4,000 outlets in total.

The bank strives to develop personal online banking and telephone banking and invests more in self-service equipment, with 4,790 ATMs and other self-service equipment added in 2007.

Bank of China tries continuously to perfect the individual customer service system by setting up 366 wealth management centers and over 1,000 wealth management studios with a specialized wealth management team of over 200 wealth management consultants and over 2,500 wealth managers to provide professional services of investments and wealth management schemes and series products. In 2007, the bank started the first private banking service in China with private banking departments set up in Beijing and Shanghai.

In accordance with the sales process for investment and wealth management products, the bank requests relationship managers to remind customers of relevant risks in purchase of wealth management products and to provide investment suggestions only with customers' full understanding and confirmation of risks.

Bank of China strives to help customers improve life quality by providing multiple financial services. By the end of 2007, the Bank had issued home loans totaling RMB 850,760 million to 3.86 million individual customers and auto loans totaling RMB 157,516 million to 1.18 million customers.

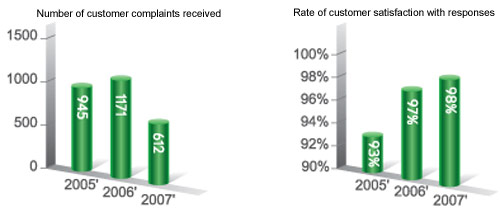

Bank of China pays high attention to the customer satisfaction with its banking services and does its best to improve the service quality by getting acquainted with customers' needs through non-scheduled customer satisfaction surveys. With persistent efforts, cases of customer complaint have declined greatly and rate of customer satisfaction with responses risen year by year.

Support for SMEs

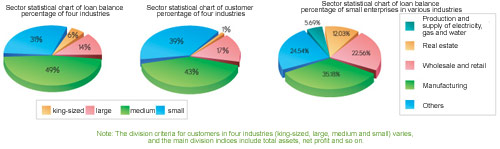

Benefited from strategic partners' experience, Bank of China improved the service mode, revised the credit policies and simplified the crediting procedures for small-and-medium-sized enterprises (SMEs). Meanwhile, based on the financing needs of SMEs, the bank launched a short-term financing product "Kuai Yi Fu" to support their innovation.

By delivering training courses, Bank of China interprets tax rebate and other new state policies to SME customers and introduces customer-targeted customs margin account and tax guarantee services.

|